0 coupon bond formula|How to Calculate Yield to Maturity of a Zero : Bacolod Reinvestment risk is the risk that an investor will be unable to reinvest a bond’s cash flows (coupon payments) at a rate equal to the investment’s required rate of return. . Tingnan ang higit pa r/TrueDoTA2. r/TrueDoTA2. A community for DotA 2 players to share informative and in-depth content including strategy discussions, balance discussions, build theorycrafting, and much more! Members Online. Carry asking questions: What to pick if your offlaner picks something non-tanky like weaver

PH0 · Zero Coupon Bond Yield

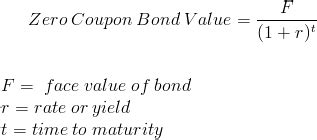

PH1 · Zero Coupon Bond Value

PH2 · Zero Coupon Bond Definition and Example

PH3 · Zero Coupon Bond

PH4 · Zero

PH5 · Value and Yield of a Zero

PH6 · How to Calculate Yield to Maturity of a Zero

Realamberthevalkyrie porn videos: WATCH for FREE on Fuqqt.com!

0 coupon bond formula*******As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an . Tingnan ang higit pa

Thank you for reading CFI’s guide on Zero-Coupon Bond. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional resources below: 1. Continuously Compounded Return 2. Effective . Tingnan ang higit paTo calculate the price of a zero-coupon bond, use the following formula: Where: 1. Face valueis the future value (maturity value) of the bond; 2. ris the required rate of return . Tingnan ang higit paReinvestment risk is the risk that an investor will be unable to reinvest a bond’s cash flows (coupon payments) at a rate equal to the investment’s required rate of return. . Tingnan ang higit pa0 coupon bond formula The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity To calculate the price of a zero-coupon bond—i.e. the present value ( PV )—the first step is to find the bond’s future value (FV), which is most frequently $1,000. .A zero coupon bond, sometimes referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments and instead pays one lump sum at . Zero-Coupon Bond, also known as Pure Discount Bond or Accrual Bond, refers to those bonds which are issued at a discount to their par value and makes no periodic interest payment, unlike a normal .0 coupon bond formula How to Calculate Yield to Maturity of a Zero Key Takeaways. Zero-coupon bonds pay no interest and are issued at a discount to face value. Investors profit by buying them below par, and they receive the .

The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond.The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond . The following formula can be used to work out value of a zero-coupon bond: Where yield is the periodic bond yield and n refers to the total compounding periods till . The price of a zero-coupon bond can be calculated by using the following formula: where: M = maturity (or face) value. r = investor's required annual yield / 2. n = .How to Calculate Yield to Maturity of a Zero Zero-Coupon Bond Price Formula. When pricing a zero-coupon bond, you can use the following formula: . Let’s now use the same example but instead, use the semi-annual compounding formula: PoB = $10,000 / (1+0.05/2) 5 x 2 = $7,812.00. So using this formula, the current price Investor X will pay today for the bond is $7,812.00. .Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; . Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. .

Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, . Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's .

Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.The formula for Zero-Coupon Bonds. The price of zero-coupon bonds is calculated using the formula given below: See also What is Straight Debt? Definition, Example, Components, And More. . (1 + 0.02/2) ^ 10 = $45.264. Advantages of Zero-Coupon Bonds. From an investor’s perspective, zero coupon bonds have the following .

A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100. $100 / $1,000 = 0.10. The bond’s coupon rate is 10%. This is the portion of its .Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate. i = Interest rate. n = number of payments. Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the . The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × . Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925 (the price at which it could be purchased today). The formula would look as follows: (1000 / 925) ^ (1 / 2) - 1. When solved, this equation produces a value of 0.03975, which would be rounded and listed as a yield of 3.98%. To calculate the coupon per period, you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value × coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 × 5%) / 1 = $50. 3. Equation to value Zero Coupon Bonds. We can use exactly the same thinking to get to the formula for the price of a zero coupon bond. . The coupon rate or “rate” is 0% because this is a zero coupon bond. The yield (or “yld”) here is 7%, given that’s the yield for Swindon Plc. The frequency’s 1 because this is a one-year annual . Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay: $10,000 / (1 + 0.04)^2 = $9,245. Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate .

The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as. This formula will then become. By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top. Key Takeaways. The coupon rate formula calculates coupon rates by multiplying the bond’s par value by 100 and dividing the total yearly coupon payments. The coupon rate represents the interest rate bond issuers pay to bondholders. It’s the fixed annual payment divided by the bond’s par value. All bonds provide annual coupon .

The Professional Regulation Commission (PRC) and the Board for Professional Teachers (BPT) announces that 24,819 elementary teachers out of 60,896 examinees (40.76%) and 48,005 secondary .

0 coupon bond formula|How to Calculate Yield to Maturity of a Zero